# Taxation rules

In the Taxation rules section of the settings page you can set special rules for taxation of individual products or groups of products. These settings are especially handy for businesses subject to special rules on exporting goods across borders or place of supply (e.g. Canadian GST/HST, EU’s new VAT e-commerce rules).

Note

Prior to adding taxation rule, you must add all the taxes which you will use in the process of creating a taxation rule.

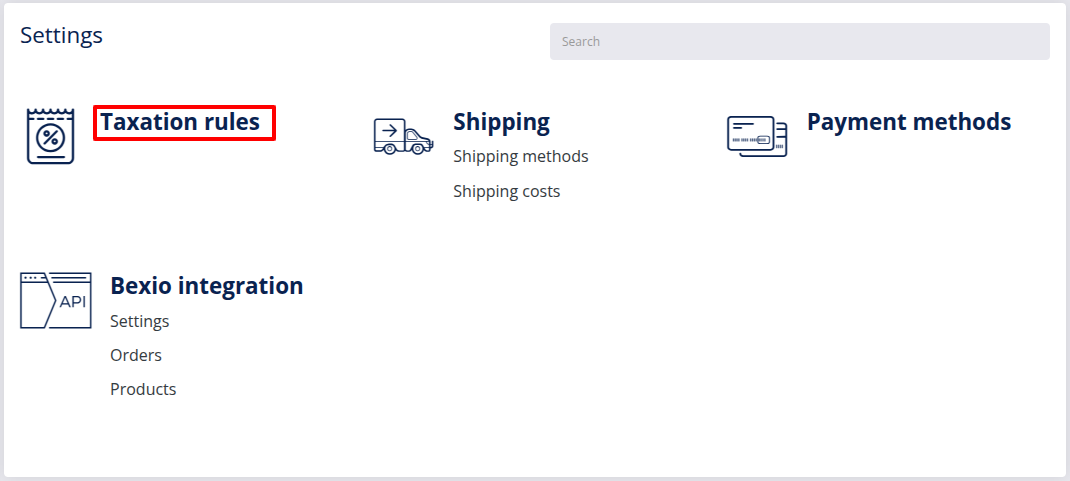

- Go to Settings and click on Taxation rules.

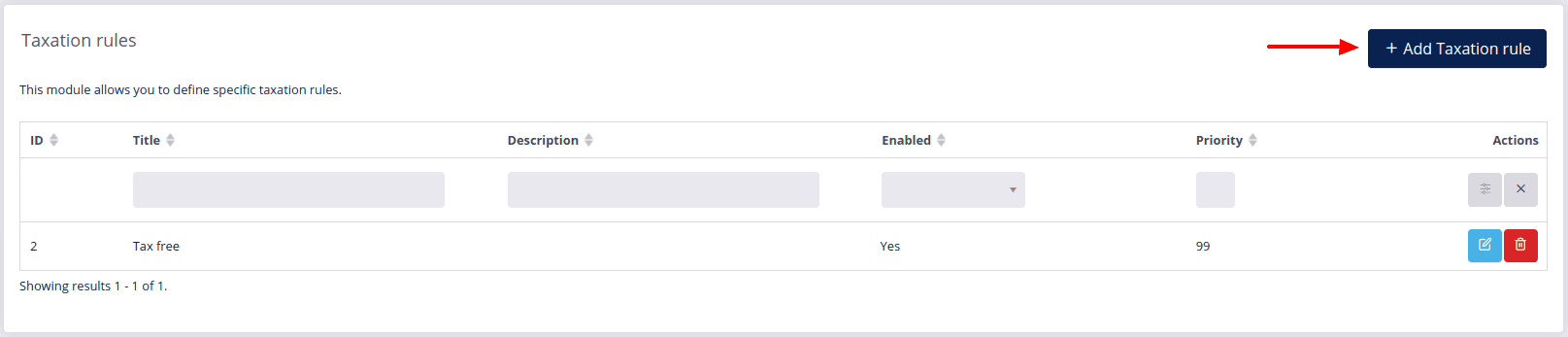

- Click Add Taxation rule

to add a new Taxation rule.

to add a new Taxation rule.

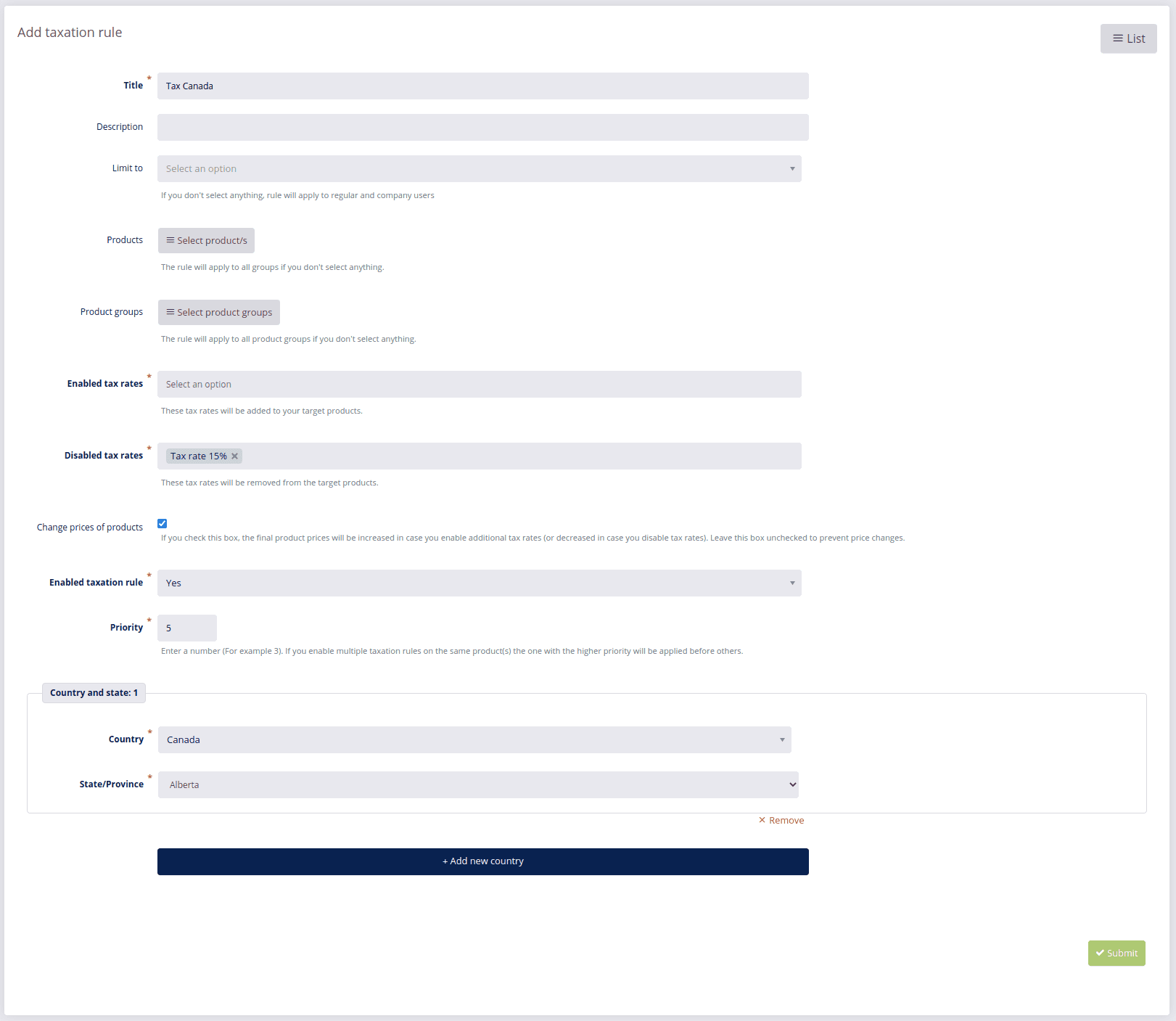

- Add a title.

- Limit the rule to either regular users or company - this is not obligatory.

- Select specific products or product groups to which the rules shall apply. If you don’t select any products or product groups, the rule will apply to all the products and product groups.

- Select the enabled tax rates.

- Select the disabled tax rates

Example

Canada has two types of taxes for the purchases inside the country. Both of the taxes are applied when goods are sent inbound. When the goods are sent internationally, the other tax must not be applied. Therefore, it has to be excluded.

- You can change the price of the products or not. If you check that prices should be changed, then the prices will be either increased or decreased - depending on the choice you made when selecting taxes. The price will change only when setting Apply discount in Site settings is set to Before tax.

- Enable taxation rule by choosing Yes. Disable it by selecting No.

- By setting high priority, this rule will be applied before the others.

- You can limit the rule to only certain countries by clicking Add new country.

- Save the taxation rule by clicking Submit

.

.

← Attributes Shipping →